Creative Money LLC offers professional financial planning services for the Seattle area. Their team is composed of highly-trained professionals who are dedicated to helping their clients achieve financial independence. Mindy Crary is the founder of the company. She has a master's degree in business administration and over 20 years experience in the financial sector. She also holds professional certifications in coaching.

Advice only from financial advisors

Only financial advisors in Seattle can provide advice and not offer any financial planning. They advise clients on their portfolio investments and give suggestions, but don't push clients into specific investments. Having said that, they also provide information about potential investment opportunities, which can be valuable. Many clients have reservations about using the services of financial advisors.

An excellent way to build a long-term financial strategy is to hire a professional financial advisor. You can have an advisor help you to build an investment portfolio that will help your reach financial goals such as retirement. A financial advisor who is local to Seattle will be familiarized with the economy and details about the businesses in the region.

Fee-based financial advisors

There are two types Seattle-based financial advisors. One is fee-based, the other is fee-only. Fee-only advisors are paid only by their clients. This is unlike a fee dependent financial advisor who receives incentives and commissions from financial product companies. Inherent conflict of interest is a result. In addition, a fee-only financial advisor is required by law to act solely in their clients' best interests.

Fee-based advisors will charge a fee which varies depending on the client. Although fees can vary between $600,000,00 and $1 million depending on the client's networth, they are usually charged at a flat rate. Many fee-based financial advisors in Seattle offer comprehensive wealth management strategies. A fee-based advisor can help with everything from portfolio management to estate planning and retirement planning.

Firms that specialize in wealth management

Seattle wealth management firms provide a range services including financial planning, investment management, and other financial services. They help individuals, companies, and pension and profit sharing plans achieve their financial goals. They can help you find the right combination of financial and investment management strategies for your financial situation.

Some of the top wealth management firms in the Seattle area include Miller Advisors, an independent fee-only wealth management firm. The firm offers comprehensive services, including investment management, retirement planning and estate planning. The firm is made up of certified financial advisors, attorneys, estate planners, as well as estate planners. The team has extensive experience helping families manage their financial needs, and has a combined 50 years of experience.

Working with a financial adviser is expensive

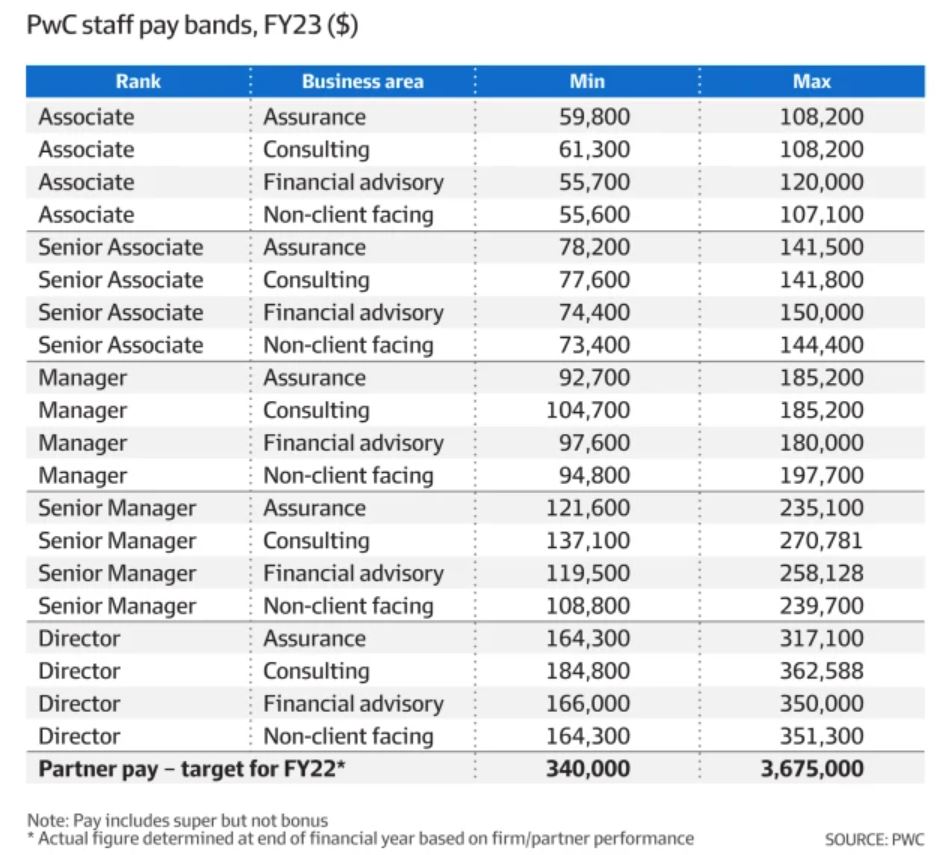

Financial advisors charge different fees depending on whether they charge an hourly rate or a fixed fee. Some advisors charge an annual fee equal to one percent of the AUM while others charge per hour. Asset management fees are charged at a range of $230 to $7500.

Before hiring an advisor, it's important that you know what each advisor charges. You may not need certain services and some advisors will charge you an hourly fee. A few advisors may charge a one time fee to answer limited questions. A good financial advisor will seek to develop a long-term relationship.

FAQ

How much do consultants make?

While some consultants may make over $100k per annum, most consultants earn between $25k and $50k. The average consultant salary ranges from $39,000 to $39,000. This includes both salaried and hourly consultants.

Salary is dependent on experience, location and industry. It also depends on whether the consultant works from home or has a remote office.

What's the difference between an advisor and a consultant?

An advisor provides information about a topic. A consultant is able to provide solutions.

To help clients achieve their goals, a consultant works directly with them. Advisors advise clients indirectly via books, magazines, lectures and seminars, etc.

What can I expect from my consultant?

Within a few days of selecting your consultant, you can expect to hear back. They will typically ask for information about the company, such as its mission, goals. products and services. budget. They will then send you a proposal that outlines the scope of work and estimates timeframe, fees, deliverables, milestones and other details.

If everything goes as planned, then both parties will agree to a written contractual agreement. The type of relationship between them (e.g. employer-employee or employer-independent contractor) will determine the terms of the contract.

If everything goes smoothly, the consultant can begin work immediately. S/he will have access to your internal documents and resources, and you'll have access to his/her skills and knowledge.

You shouldn't assume, however, that every consultant is an expert in all areas. To become an expert in any field you consult, it takes practice and effort. So, don't expect your consultant to know everything about your business.

Is it possible that a consultant business can be started from home?

Absolutely! Indeed, many consultants already do this.

Freelancers often work remotely through tools like Skype and Trello, Basecamp, Basecamp, Dropbox, and Slack. Many freelancers set up their own office space to avoid missing out on company perks.

Freelancers might prefer to work in libraries or cafés, rather than traditional offices.

Some choose to work remotely because they are surrounded by their family.

Of course, working from home has its pros and cons. However, if you love what you do, it is worth considering.

Statistics

- Over 50% of consultants get their first consulting client through a referral from their network. (consultingsuccess.com)

- So, if you help your clients increase their sales by 33%, then use a word like “revolution” instead of “increase.” (consultingsuccess.com)

- According to statistics from the ONS, the UK has around 300,000 consultants, of which around 63,000 professionals work as management consultants. (consultancy.uk)

- According to IBISWorld, revenues in the consulting industry will exceed $261 billion in 2020. (nerdwallet.com)

- My 10 years of experience and 6-step program have helped over 20 clients boost their sales by an average of 33% in 6 months. (consultingsuccess.com)

External Links

How To

How can I start my own consulting business?

A simple and effective way to get started with your own consultancy business - without any capital investment!

This tutorial will help you learn how to make extra money while working remotely, improve your skills, and achieve success.

These secrets will help you generate traffic on demand. This is especially important when people are looking for something specific.

This method is called 'Targeted Traffic'. This is how this method works...

-

You should choose the niche you wish to work in.

-

You can find out what keywords people use to search Google for solutions.

-

These keywords should be used to create content.

-

Post your articles on article directories.

-

Make sure to use social media sites for promotion of your articles.

-

Build relationships with influencers and experts in that niche.

-

Be featured on these blogs or websites.

-

Sending emails can help you grow your email list.

-

Start making money.