A retirement advisor evaluates and analyses the client's financial situation, annual income, debts, and other factors to help create a customized plan for retirement. This plan will guide the client throughout retirement. The advisor can make recommendations regarding a variety retirement planning products. When working with an advisor, the client should expect to pay a fee for this service.

Qualifications for a retirement planner

Among the qualifications of a retirement advisor is the ability to manage retirement funds effectively. Therefore, it is crucial to be knowledgeable in the fields taxation, planning, and economics. These credentials will help you build your credibility and make you a valuable asset to clients.

Those who wish to become a retirement advisor should have a bachelor's degree. It is a good idea to have a degree in finance, business or another related field. However, experience is still a great teacher. Many advisors learn their craft through real-world experience. Advisors are required to undergo on-the job training. This can be up to a year. They learn about their responsibilities and create a client network. In addition, they must complete certification programs, which require additional schooling and work experience.

Cost of a retirement adviser

Although every person is different in cost, there are some common guidelines that you can use to help you choose the right advisor. While fees can be anywhere from $700 up to $3,500 in general, they are not always related to the purchase price of your investments. Before signing anything, it is important to get a written estimate of the fees. In addition, be sure to ask about whether follow-up meetings are included.

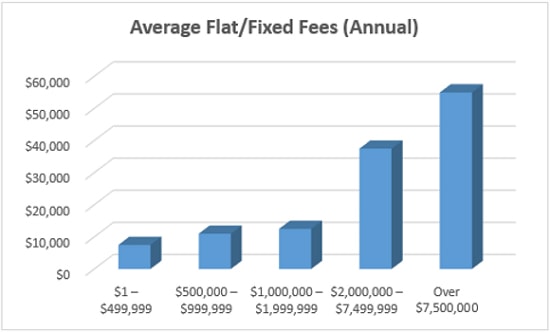

Some advisors charge a flat fee and do not charge assets. Others charge a flat monthly, annual, or annual fee. Fee-only advisors may charge a $1,000 initial fee. Due to the nature of the work involved, the initial fee can be higher but subsequent meetings should be relatively inexpensive.

Conflicts of interest working with a retirement adviser

It is not easy to work with a retirement adviser. Even though advisors are supposed be acting in your best interests, conflicts can arise when advisors receive hidden fees or back-door payment. They could direct you to low-return, high-cost investments that offer hidden fees that favor Wall Street firms. Clients are losing an average of one point per year on their investments.

Conflicts can arise when there are relationships between professionals, organizations and centers with influence. According to regulatory guidelines, advisors must disclose their business affiliations as well as how they manage conflicts. The guidelines do not prohibit conflicts of interests. Any financial relationships that a retirement advisor has with other people should be disclosed.

Time to hire a retirement adviser

If you are just starting your career or are planning your retirement, it may be time to hire a financial advisor. A financial advisor can help you plan your retirement benefits and avoid financial hardship later in life. The advisor should have the appropriate experience and expertise to provide sound advice. In addition, they can help you choose appropriate insurance policies and strategies to help you minimize your tax liability.

It is a good idea to interview several advisors before you choose the best one. You may want to choose one who is experienced in working with clients like you, including those of color or LGBTQ. Also, you can ask about their fees. Do they charge per hour, retainer, percentage, etc. It is important to have a written agreement before you hire a financial adviser.

FAQ

How much do consultants make?

While some consultants make $100k+ per year, most consultants only earn between $25-$50k. A consultant's average salary is $39,000 This includes both salaried and hourly consultants.

Salary is dependent on experience, location and industry. It also depends on whether the consultant works from home or has a remote office.

What is the difference between a consultant and an advisor?

An advisor gives information on a topic. A consultant can offer solutions.

Consultants work directly with clients to help them reach their goals. Advisors advise clients indirectly via books, magazines, lectures and seminars, etc.

Who hires consultants

Many organizations hire consultants to assist with projects. These consultants can be found in small and large businesses as well as government agencies, universities, educational institutions, non-profits, and education institutions.

These consultants may work directly for the organization, or freelance. In both cases, the process for hiring depends on how complex and large the project is.

You will likely go through multiple rounds of interviews when hiring consultants before you choose the candidate you feel is the best fit for the job.

Is it possible to run a consultancy business from home?

Absolutely! Many consultants do this already.

The majority of freelancers work remotely with tools like Skype. To avoid being left out of company perks, they often set up their own office space.

Some freelancers prefer working in cafes and libraries over traditional offices.

Others choose to work at home because they love being with their children.

There are pros and cons to working remotely. It is worth it if you love your work.

How do you start an LLC consultancy company?

First, you must decide what your goals are as a service provider. The next step is to ensure that you're qualified for the services you offer. It may also be beneficial to look for someone who is already qualified to do what you desire and to see how they work.

Once you've identified the product or service you wish to offer, it is time to determine your target market. If they aren't available, you may need them to be created.

Next, you will need to decide if you want to start your own business or hire others.

Another option is to get a state license. This requires a lot of paperwork and legal fees.

What can I expect from my consultant?

When you choose your consultant, they should respond within a few working days. They will request information about your company including its mission and goals, products, services, budget, and other pertinent details. After receiving this information, they will prepare a proposal outlining their scope of work, estimated timeline, fees, deliverables and milestones.

If all goes well, the parties will then negotiate a written agreement. The terms of the contract will depend on the type of relationship between the two parties (e.g., employer-employee, employer-independent contractor).

If everything goes as planned, the consultant may begin to work immediately. The consultant will have full access to your files and resources. You'll also have access to their skills and knowledge.

However, don't assume that just because someone is a consultant that s/he knows everything. To become an expert in any field you consult, it takes practice and effort. So, don't expect your consultant to know everything about your business.

Statistics

- On average, your program increases the sales team's performance by 33%. (consultingsuccess.com)

- My 10 years of experience and 6-step program have helped over 20 clients boost their sales by an average of 33% in 6 months. (consultingsuccess.com)

- According to statistics from the ONS, the UK has around 300,000 consultants, of which around 63,000 professionals work as management consultants. (consultancy.uk)

- "From there, I told them my rates were going up 25%, this is the new hourly rate, and every single one of them said 'done, fine.' (nerdwallet.com)

- Over 50% of consultants get their first consulting client through a referral from their network. (consultingsuccess.com)

External Links

How To

How to Start a Consultancy Company and What Should I Do First

It's a great way for you to make money online by starting a consulting company. You don't need any previous business experience or investment capital. You can start your own consulting firm by building a website. Once you've built a website, you'll want to use social media platforms such as Facebook, Twitter, LinkedIn, Instagram, Pinterest, YouTube, etc... to get the word out about your services.

You can create a marketing strategy that includes these things with these tools

-

Blog Content Creation

-

Building relationships (contacts)

-

Generating leads, also known as lead generation forms

-

Selling products on e-Commerce websites

After you have developed your marketing strategy, it's time to find clients willing to pay for your services. Some people prefer to go through networking groups and events, while others prefer to use online methods such as Craigslist, Kijiji, etc. It's up to you to make the decision.

Once you've found new clients, you'll want to discuss terms and payment options. These could be hourly fees, retainer arrangements, flat-fee contracts, or other types of fees. Before you accept a client, you need to know what you expect so that you can communicate clearly all through the process.

An hourly contract is the most popular type of contract for consulting services. This contract allows you to pay a fixed amount each week or month for certain services. Depending on the type of service you are offering, you may be able to negotiate a discount depending on the length of the contract. You must fully understand the contract you're signing before you agree to it.

Next, you will need to create invoices that you can send to your clients. Invoicing is one of those things that seems simple until you actually try it. You have many options to invoice your clients. You can choose to have your invoices sent directly to your clients or to print them and send them. No matter which method you choose to use, it is important that it works for you.

After you've finished creating invoices, you'll want to collect payments. PayPal is the most popular payment option because it's easy to use and provides multiple payment options. There are many other payment options, such as Square Cash, Square Cash and Google Wallet.

Once you are ready to start collecting payments, it is time to open bank accounts. Having separate checking and savings accounts allows you to track income and expenses separately. When paying bills, it is also beneficial to set up automatic transfer into your bank account.

When you start a consultancy business, it may seem overwhelming, but once you learn how to do it correctly, it becomes second nature. You can read our blog post to learn more about how to start a consultancy business.

You can make extra money by starting a consulting company without worrying about staff. Consultants can work remotely so they don't have the hassle of dealing with office politics and long working hours. Since you are not tied down by regular working hours, you have more flexibility than a traditional employee.